Stamp duty is a tax payable to the relevant state or territory when you purchase or acquire an interest in a commercial property. However according to Stamp Duty Remission Order 2003 all contract notes relating to the sale of any shares stock or marketable securities listed on a stock exchange approved under subsection 82 of the Securities Industry Act 1983 are waived from stamp duty exceeding MYR200 calculated at the prescribed rate in item 31 of the First Schedule.

1 Nov 2018 Budgeting Inheritance Tax Finance

Generally the stamp duty is paid by the buyer in some cases the buyer and seller decide to split the stamp duty as per an earlier signed agreement.

. Company or individual subject to very few exceptions for collective investment vehicles such as REITs. Buyers will be sent this in an email sometime. An instrument relating to the sale and purchase of retail debenture and retail sukuk as approved by the Securities Commission under the Capital Markets and Services Act 2007 Act 671 are exempted from stamp duty.

What is stamp duty. Devolving stamp duty and landfill tax to Scotland to replace them with new taxes specific to Scotland. When do you have to pay stamp duty.

Stamp duty exemption on instrument of agreement for a loan or financing in relation to a Micro Financing. A revenue stamp tax stamp duty stamp or fiscal stamp is a usually adhesive label used to collect taxes or fees on documents tobacco alcoholic drinks drugs and medicines playing cards hunting licenses firearm registration and many other thingsTypically businesses purchase the stamps from the government and attach them to taxed items as part of putting the items on. Just as the stamp duty rate varies from state to state so does the timeframe in which people need to pay it.

The law on stamping and registration. You can use such old stamp paper for a new agreement. Stamp duty in India is governed by two legislations ie a stamp Act legislated by the Parliament and a stamp Act legislated by the state legislature.

From 1st April 2021 a 2 stamp duty surcharge was introduced for overseas buyers on the purchase of residential property in England and Northern Ireland. Stamp duty exemption on loanfinancing agreements executed from 1 January 2022 to 31 December 2026 between MSMEs and investors for funds raised on a peer-to-peer P2P platform registered and recognised by the Securities Commission Malaysia. Such stamp paper can be used only for that purpose.

Income Tax Act 1967 International Affairs. She also said in the statement she was referring to Buyers Stamp Duty an additional upfront tax on non-permanent resident buyers imposed by the government in 2012. Feel free to use our calculators below.

Relief From Stamp Duty. There is no stamp duty Tax applied to the first 125000. Some examples of documents where stamp duties are applicable include your Tenancy Agreement Instrument of Transfer and Loan Agreements.

Stamp duty is the governments charge levied on different property transactions. Stamp Duty Land Tax SDLT is a tax paid by the buyer of a UK residential property when the purchase price exceeds 125000. Stamp duty fees are typically paid by the buyer not the seller.

Your conveyancer or legal adviser can do the paperwork. The Scottish Government to have borrowing powers up to 5 billion. Stamp duty on rental agreements.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia. The stamp duty rate ranges from 2 to 12 of the purchase price depending upon the value of the property bought the purchase date and whether you are a multiple home owner. Any change is applied across all tax bands.

Home sales slumped about 57 by value in July from a year earlier according to the citys Land Registry. You need to pay a stamp duty when you buy a property and also when you go in for a rental agreement. What is stamp duty.

Amendments To The Stamps Act 1949. Lee will deliver his policy address in October. The ability to raise or lower income tax by up to 10p in the pound.

The surcharge applies to non-resident buyers regardless of the type of buyer eg. How to calculate the new stamp duty rate. The stamp duty shall be remitted to the maximum of RM200.

Stamp duty is generally payable at the time of purchase or very soon after. The Act gave extra powers to the Scottish Parliament most notably. Also read all about income tax provisions for TDS on rent.

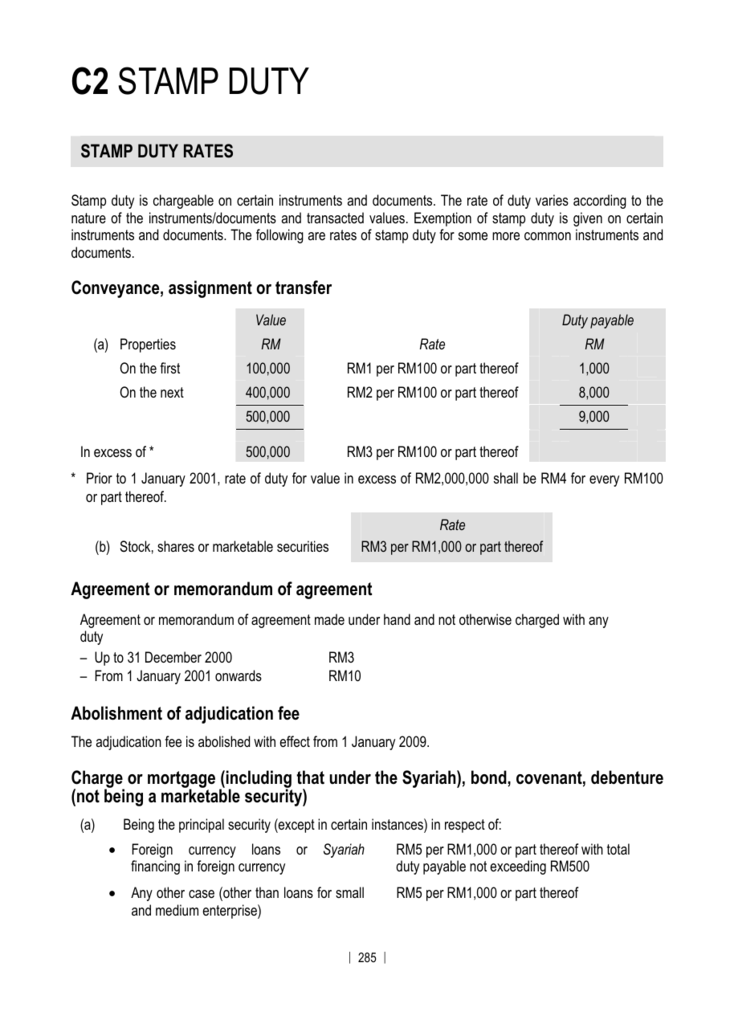

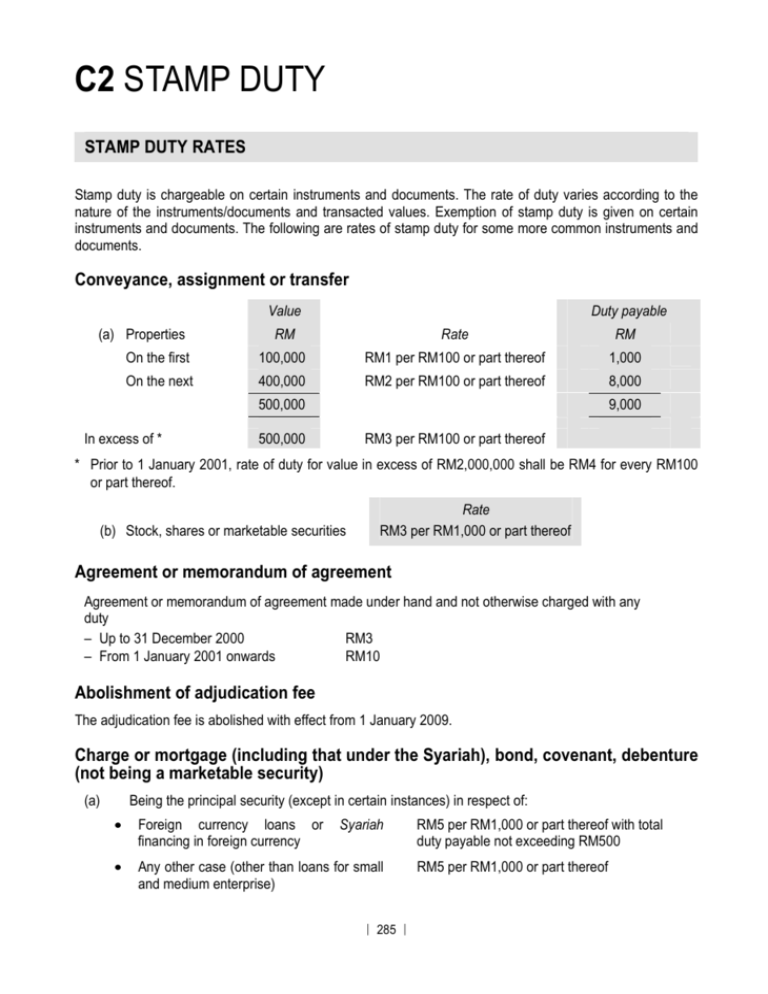

ACT payable within 28 days of settlement purchasers must pay stamp duty within 14 days of receiving a Notice of Assessment from Access Canberra. The stamp duty for sale and purchase agreements and loan agreements are determined by the Stamp Act 1949 and Finance Act 2018The latest stamp duty scale will apply to loan agreements dated 1 January 2019 or later and to sale and purchase agreements and instruments of transfer dated 1 July or later. But you must keep in mind that according to Section 29 Indian Stamp Act stamp vendor makes an entry in the record and on the stamp paper regarding full details of the person buying the stamp and the purpose for which it was purchased.

The Indian Registration Act provides for registration of documents thereby recording the contents of the document. Registration is required to conserve evidence and title. There are certain agreements mentioned under section 17 of the Indian Registration Act which are to be compulsorily registered and thus cannot be made without stamp paper.

In fact its one of the main sources of government revenue. Stamp duty is a tax on legal documents in Malaysia. Stamp duty is payable under Section 3 of the Indian Stamp Act 1899.

C2 Stamp Duty The Malaysian Institute Of Certified Public

First Time Home Buyers To Enjoy Stamp Duty Exemption Mrt3 Project To Boost Construction Sector And More

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Stamp Duty For Transfer Or Assignment Of Intellectual Property Koo Chin Nam Co

Stamp Duty In Malaysia Everything You Need To Know

Evidentiary Value Of Unstamped Insufficiently Stamped Docs

Stamp Duty And Contracts Yee Partners

The Validity Of Unstamped Agreements In Malaysia Fareez Shah And Partners

Ad Valorem Stamp Duty Damian S L Yeo L C Goh

Stamp Duty And Its Significance In Agreements Ipleaders

Stamp Duty In Malaysia Everything You Need To Know

Mm Tax Alerts Myanmar Stamp Duty Penalty Reductions Kpmg Myanmar

An Analysis Of The Registration Requirements Of A Payable Stamp Duty Ipleaders

Stamping A Contract Is An Unstamped Contract Valid

Changes Proposed To Stamp Act In Malaysia Conventus Law

C2 Stamp Duty The Malaysian Institute Of Certified Public

A Family 4 000 Better Off A First Time Buyer Who S Celebrating And The Farmhouse Couple Who Stand To Lose 18 000 How The Stamp Duty Bonanza Affects Real Pe Real People Celebrities First Time

Gift Deed Conditions And Stamp Duty

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate Malaysia